Winter is here and the cold weather means it’s time to crank up your furnace and water heater – but that can mean skyrocketing utility bills. With already tight budgets due to the highest inflation in decades and a possible recession, no one wants the additional financial burden of high energy costs. But don’t worry, there are lots of ways you can reduce your winter heating bills without sacrificing your family’s comfort. In this article, we’ll look at some simple tips for keeping those household energy bills in check during the colder months. Read on to find out how you can save money while staying warm and cozy all season long!

Get Your Furnace and Water Heater Serviced

If you want to lower your monthly energy costs and enjoy a comfortable home this season, having your water heater and furnace serviced can make a big difference. A professional checkup can help identify problems and provide a tune-up so that both appliances work more efficiently, helping lower your monthly energy bills. Plus, catching minor issues now can help reduce the need for major repairs in the future! Don’t wait – contact D&F today to schedule a water heater inspection to help ensure peak performance from this important appliance.

Improve Your Basement and Attic Insulation

Attics and basements are responsible for the bulk of a home’s energy loss. Fortunately, there are some simple and relatively inexpensive ways to make your attic and basement more energy-efficient. Improving the insulation around attic and basement walls, ceilings and floors can help these parts of your home retain more heat. Additionally, sealing attic entrances and placing weatherstripping around window frames in your basement (and your attic if you have attic windows), will significantly reduce air leaks. This will help keep the main living area of your home more comfortable and reduce the use of – and wear and tear on – your furnace.

Lower Your Thermostat to Lower Your Energy Bills

When the weather gets colder in winter, it’s understandable if your first instinct is to crank the furnace higher. However, small changes made to your thermostat temperature can equal big savings on your energy bill. Every degree lower translates to a savings of about 2-4%. You may not even notice a temperature difference of one or two degrees. And even if you do, it may be worth putting on a sweater to save some money.

Get Tax Breaks for Making Your Home More Efficient

Energy Efficiency Home Improvement Credit

The Inflation Reduction Act of 2022 includes an Energy Efficiency Home Improvement Credit that provides tax credits for making improvements to your furnace, insulation, and water heater. So, how does it work? If you make one of the covered home improvements, you can get back up to 30% of what you spent in the form of a tax credit, up to an annual maximum of $1,200. A wide range of home improvements are covered, from installing new, more efficient windows to buying new appliances, to adding insulation to your home. For some improvements, the annual maximum is not based on what you spend, it’s fixed – for example:

- $250 per exterior door (up to a $500 maximum for all exterior doors);

- $600 for new exterior windows and skylights, central air conditioners; natural gas, propane, or oil water heaters; natural gas, propane, or oil furnaces, or boilers

- $2,000 for natural gas or electric heat pump water heaters or natural gas or electric heat pumps (these are a high-efficiency combination of furnace & A/C unit).

If you space out your qualifying home improvements, you can receive the maximum tax credit for multiple years in a row. And finally, if you’re not sure where to start, you can receive a $150 tax credit when you get a home energy audit. For more information on these tax credits and how they work, consult with a licensed tax professional.

High-Efficiency Electric Home Rebate Program

Another provision of the Inflation Reduction Act of 2022 that could save you money is the High-Efficiency Electric Home Rebate Program. Instead of a tax credit that reduces the tax you owe dollar-for-dollar, this program provides a discount for similar home improvements. The difference is that to qualify, your annual household income must be less than 150% of the median household income where you live. This calculator estimates the value of the incentives your household is eligible for. Here are some maximum rebate amounts for qualifying homeowners:

- $840 for a stove, cooktop, range, oven, or a heat pump clothes dryer

- $1,600 for insulation, air sealing, or ventilation improvements

- $1,750 for a heat pump water heater

- $2,500 for electrical wiring

- $8,000 for a heat pump to heat and cool your home

The tax credits above may be combined with these discounts, provided you meet all of the requirements and are eligible for both programs. Because this program is new and is administered by the states, they’re still working out how these discounts will work. They may not be in place until later in 2023, but you can start planning now.

Making qualifying improvements is a great way to save on your taxes and reduce your utility bills, and we can help. We’re experts at installing heat pump water heaters which are eligible for a tax credit and, if you’re eligible, a rebate. Contact the team at D&F Plumbing, Heating and Cooling today to schedule a consultation to get a new, money-saving heat pump water heater installed.

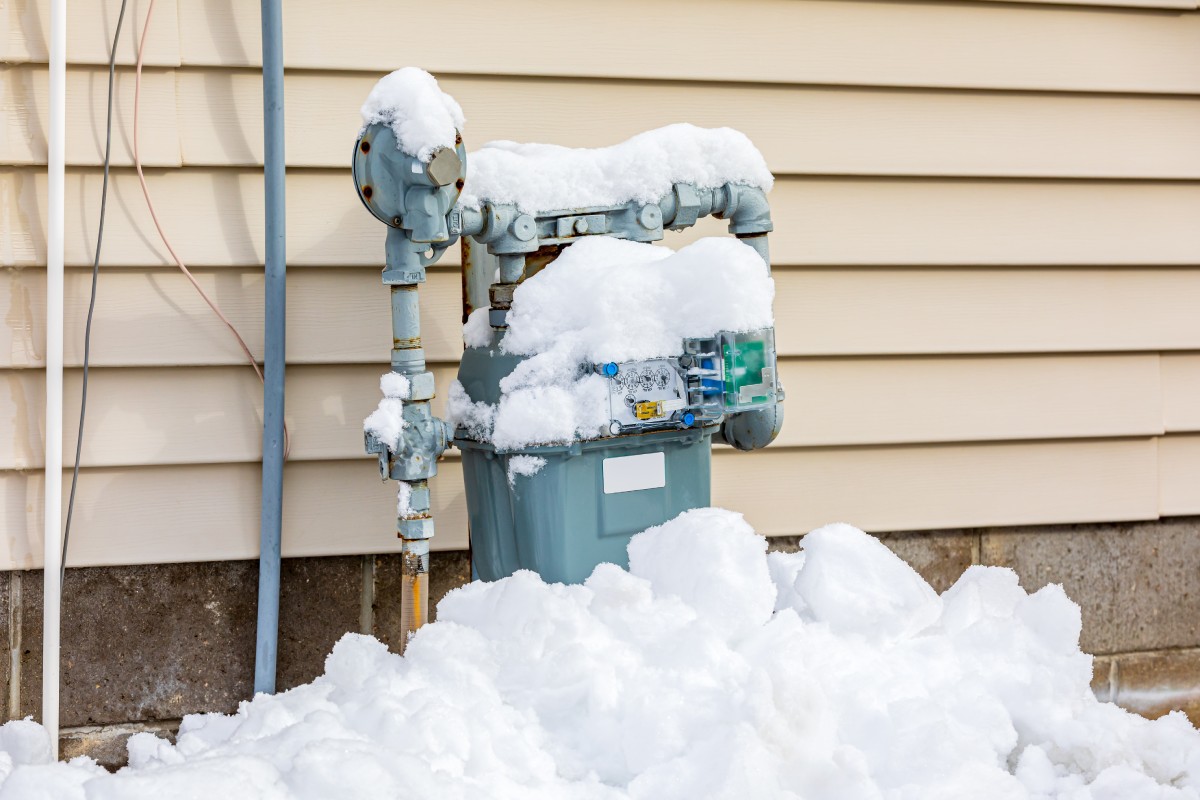

Between freezing weather and holiday festivities, the winter months can take a serious toll on your water heater. To ensure you have plenty of hot water all throughout the cold season, it’s important to prepare your water heater for winter as soon as temperatures begin to drop. Fortunately, seasonal maintenance doesn’t have to be difficult or expensive.

Between freezing weather and holiday festivities, the winter months can take a serious toll on your water heater. To ensure you have plenty of hot water all throughout the cold season, it’s important to prepare your water heater for winter as soon as temperatures begin to drop. Fortunately, seasonal maintenance doesn’t have to be difficult or expensive.